Gifts of Life Insurance - Gift-Replacement

How It Works

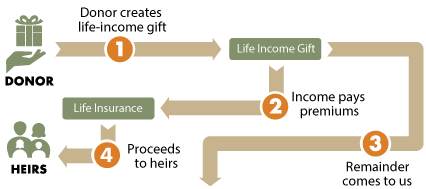

- You create a gift plan like a Charitable Gift Annuity or a Unitrust that will pay you income for your lifetime.

- You also create a life insurance policy, naming your children or other heirs as beneficiaries. The amount of the death benefit replaces the contribution you made to create your life-income gift.

- You pay the premiums for the policy from the income you are receiving from your life-income gift.

- At your death, Audubon receives the remaining balance of your gift plan, and your heirs receive cash in the amount of your original gift.

Benefits

- You make a significant gift to Audubon with no negative effect on your family's financial security.

- After your gift, your estate is replenished for the benefit of your heirs.

- No new assets are required to pay for this replacement: tax-savings from the charitable deduction plus income you receive from your new gift plan pay the premiums.

- Donors with large families or children who will need long-term assistance can consider helping Audubon at a level they never thought possible.

- One asset can do the work of two: make a gift to Audubon and provide an equal benefit to your heirs.

Next

- More detail on gifts of life insurance - gift-replacement.

- Frequently Asked Questions on gifts of life insurance - gift-replacement

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org