Charitable Gift Annuity

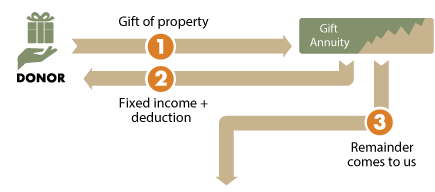

How It Works

- You transfer cash or securities to Audubon.

- Audubon pays you or one other beneficiary you name fixed income for life.

- The remaining balance passes to Audubon when the contract ends at the death of the last beneficiary.

Note:

- Beneficiaries must be at least 65 at the time of the gift.

- Our minimum gift requirement is $10,000.

Benefits

- Receive dependable, fixed income for life in return for your gift.

- In many cases, increase the yield you are currently receiving from stocks or CDs.

- Receive an immediate income tax deduction for a portion of your gift.

- A portion of your annuity payment will be tax-free.

"The regular payments are great but what makes me even happier is knowing that even when I'm gone, my gift will help Audubon protect the birds I love" – Jan Roberts, Austin TX

"The regular payments are great but what makes me even happier is knowing that even when I'm gone, my gift will help Audubon protect the birds I love" – Jan Roberts, Austin TX

Next

- More detail on gift annuities.

- Frequently Asked Questions on gift annuities

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org