Gifts From Your Will or Trust

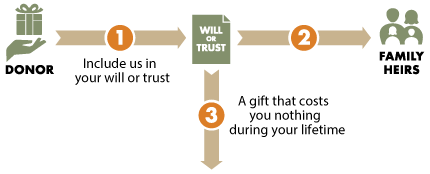

How It Works

- Include a bequest to Audubon in your will or trust. (Here's sample bequest language.)

- Make your bequest unrestricted or direct it to a specific purpose at Audubon.

- Indicate a specific amount, or a percentage of the balance remaining in your estate or trust.

How to Say It

I give __________ (dollar amount or % of estate) to the National Audubon Society, Inc., a not-for-profit organization, with its principal offices located at 225 Varick Street, 7th Floor, New York, NY 10014. Tax ID # 13-1624102. This gift should be used for (Audubon’s ongoing conservation work; programs in the state of , etc).

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your bequest to address changing circumstances.

- You can direct your bequest to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Under current tax law there is no upper limit on the estate tax deduction for your charitable bequests.

"Audubon's efforts in science, education, advocacy and on-the-ground conservation have had an enormous impact and a global reach. Our decision to make annual contributions to Audubon and to include Audubon in our estate planning is an investment in the future of conservation and for the benefit of birds and people alike for generations to come."

"Audubon's efforts in science, education, advocacy and on-the-ground conservation have had an enormous impact and a global reach. Our decision to make annual contributions to Audubon and to include Audubon in our estate planning is an investment in the future of conservation and for the benefit of birds and people alike for generations to come."

- Susan & David Baker, Cary NC

Next

- More detail about gifts from your will or trust.

- Frequently Asked Questions about gifts from your will or trust.

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org