Charitable Remainder Unitrusts

How it Works

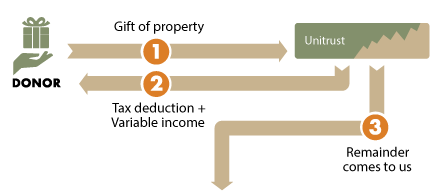

- You transfer cash, securities or other appreciated property into a trust.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or beneficiary(ies) you name.

- When the trust terminates, the remainder passes to Audubon to be used as you have directed.

Benefits

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no upfront capital gains tax on appreciated assets you donate.

- You can make additional gifts to the trust as your circumstances allow for additional income and tax benefits.

Next

- More detail about charitable remainder unitrusts.

- Frequently Asked Questions on charitable remainder unitrusts.

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org