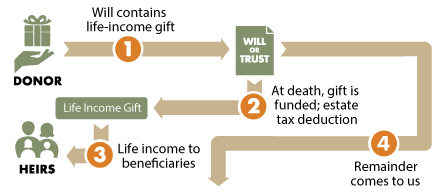

Testamentary Life-Income Gifts

How It Works

- You write a will or revocable trust directing a bequest to Audubon.

- You provide that the bequest first create a life-income gift benefiting your designated recipients.

- After their income interest terminates, the remaining balance in the gift passes to Audubon to be applied to the purposes you specify.

Benefits

- One estate asset can benefit both Audubon and your heirs or other desired beneficiaries.

- Your estate will be eligible to claim a charitable deduction for a portion of the amount of your bequest.

- You can modify your bequest if your circumstances change.

Next

- More detail on testamentary life-income gifts.

- Frequently Asked Questions on testamentary life-income gifts

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org