Retained Life Estate

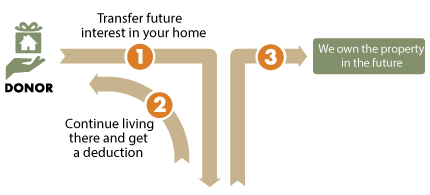

How it Works

- You transfer your residence, farm, or vacation home to Audubon.

- You continue to live in the property for life or a specified term of years, and continue to be responsible for all taxes and upkeep.

- The property passes to Audubon when your life estate ends.

Benefits

- You can give us a significant asset, and retain lifetime use.

- You receive an immediate income tax deduction for the gift portion.

- You can terminate your life estate at any time and may receive an additional income tax deduction.

Next

- More detail about retained life estates.

- Frequently Asked Questions about retained life estates.

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org