Gifts of Partnership Interests

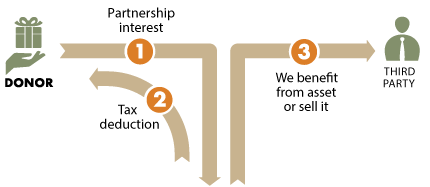

How It Works

- You convey a partnership interest to National Audubon Society.

- Depending on the circumstances, Audubon may choose to hold the partnership interest or to sell it quickly. Any partnership distributions or sales proceeds will be applied to the purposes you designate.

Benefits

- You receive gift credit and an immediate income tax deduction for the appraised value of the donated partnership interest, net of any liabilities.

- Under certain conditions, you may be able to use a partnership interest to fund a life-income arrangement, such as a Unitrust.

- You can have the satisfaction of making a significant gift that benefits both you and Audubon during your lifetime.

Next

- More detail on gifts of partnership interests.

- Frequently asked questions on gifts of partnership interests

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org