Gifts of Life Insurance - Paid-Up Policy

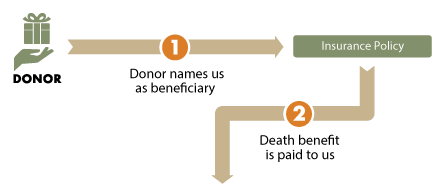

How It Works

- You transfer ownership of a paid-up life insurance policy to Audubon.

- Audubon cashes in the policy now or maintains it and receives the death benefit later.

Benefits

- You receive gift credit and an immediate income tax deduction for the cash surrender value of the policy.

- In some cases, you can use the cash value in your policy to fund a life-income gift, such as a deferred gift annuity.

- You gain the satisfaction of making a significant gift to the National Audubon Society without adversely affecting your cash flow.

Next

- More detail on gifts of life insurance - paid-up policy

- Frequently Asked Questions on gifts of life insurance - paid-up policy

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org