Donor Advised Fund

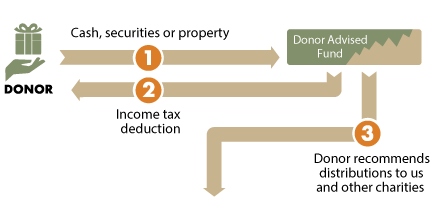

How It Works

- Ask your financial advisor if they offer Donor Advised Funds (if not, contact Audubon’s gift planning specialists for help finding a provider).

- You make an irrevocable gift to the fund. Your fund’s manager may have a minimum initial gift size of $5,000 or more.

- You receive a charitable tax deduction when you deposit money into the fund.

- Money remains in your fund until you decide to distribute it to Audubon or other charities, on your timetable.

- Your Donor Advised Fund is invested and may grow over time.

Benefits

- Control. You or family members you designate have advisory privileges over the fund and may recommend distributions to support specific areas of Audubon and other qualified charitable organizations.

- Tax advantages. You may claim a federal charitable income tax deduction in each year you contribute to your fund. There is no capital gains tax due on appreciated assets, and the gifts may reduce your gross taxable estate.

- Flexible payouts. You can distribute funds to Audubon and other charities on your own timetable.

- Your giving can grow for good causes. Fund contributions may be invested in mutual funds or exchange-traded funds, as well as cash accounts.

- Simple record-keeping. Your fund manager handles the administration of your donations, including your receipts and paperwork.

Next

- More detail on donor advised funds.

- Frequently asked questions on donor advised funds

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org