Gifts of Personal Property

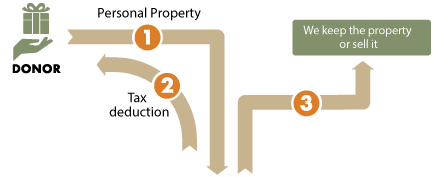

How It Works

- You transfer a valuable painting, antiques, or other personal property to Audubon.

- Audubon may hold and display the property or use it in the furtherance of its mission.

- Audubon may sell the property at some point in the future and use the proceeds for its mission.

Benefits

- You receive an immediate income tax deduction for the appraised value of your gift and pay no capital gains tax, so long as the gift can be used by Audubon to carry out its mission.

- In certain cases, you can use personal property to fund a life-income gift that provides you and/or other loved ones with an income now and benefits Audubon in the future.

Next

- More detail on gifts of personal property.

- Frequently Asked Questions on gifts of personal property.

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org