Gifts of Business Interests

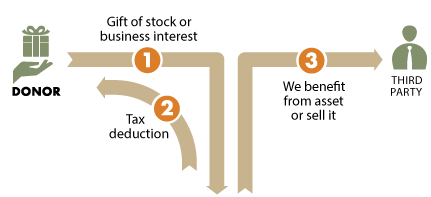

How It Works

- You give shares of closely-held stock to the National Audubon Society.

- Audubon may hold the shares and collect the dividends, or it may offer the stock back to your company for redemption or re-purchase. Audubon will apply dividends or the proceeds to the purposes you wish to support.

Benefits

- You receive gift credit and an immediate income tax deduction for the appraised value of your shares, even if their original value was close to zero.

- You pay no capital gains tax on any appreciation that has taken place in the shares.

- Under certain conditions, you may be able to use closely-held shares to fund a life-income arrangement.

- You can make a significant gift that benefits both you and Audubon during your lifetime without using your cash reserves to do so.

Next

- More detail on gifts of business interests.

- Frequently asked questions on gifts of business interests

- Contact us so we can assist you through every step.

We’re Here To Help! Please contact us for further assistance.

Office of Gift Planning

National Audubon Society

225 Varick Street, 7th Floor

New York, NY 10014

212-979-3033

plannedgifts@audubon.org